Santander Digital Wealth

With a track record of over 45 years in Miami, Banco Santander International (BSI) is pleased to offer Santander Digital Wealth. This new service, exclusive to the United States, allows you to open an international account in dollars and manage it through our app quickly and securely from anywhere.(1)

Discover all the advantages and benefits that Santander Digital Wealth has to offer

Your Santander Digital Wealth(2) account

Quickly and easily open an international account and enjoy all its advantages:

- US dollar account without having to travel to the US

- Easy and convenient opening process

- Investment account starting at US$100,000

- No maintenance, custody, or purchase/sale fees(3)

- Customer service in your language

Benefits at your fingertips

Start operating your account from our app, wherever and whenever you want. Access:

- Fixed income, mixed and equity investment funds according to your needs and interests

- Investment proposals designed according to your risk profile and with our digital advice(4)

- Credit card* in dollars for travel and purchases abroad

- Electronic transfers between accounts held by the same account holder, with a maximum of 5 incoming and outgoing transfers per month

*Available in Q4 2025

Taking your wealth to the next level

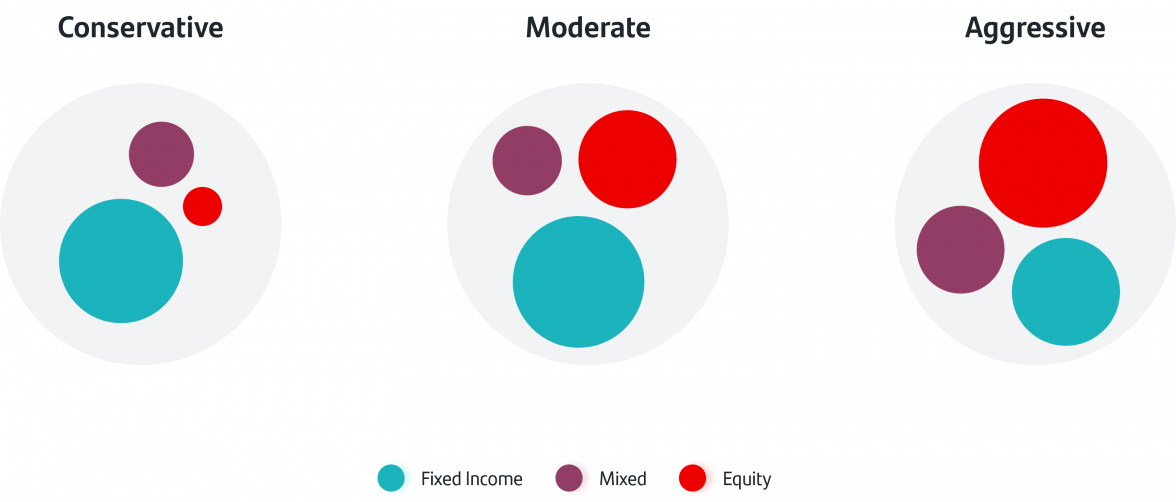

We offer a limited range of proprietary and third-party investment funds based on your financial risk profile

With you every step of the way

Our team provides personalized service, available in Spanish, English, and Portuguese

(1) Terms and conditions apply.

(2) Santander Digital Wealth clients have access to a limited range of investment products, consisting of affiliated and non-affiliated funds for which BSI receives compensation directly from the issuers, managers, and/or distributors, whether affiliated or non-affiliated, including, among others, management fees.

(3) Transfers can be made from any Santander bank worldwide and from any Santander Group bank in Argentina, Brazil, Chile, Mexico, Europe, United Kingdom and United States that uses the SWIFT system. Transfers to banks outside the Santander Group are subject to a fee of US$65 per transfer. The Client must maintain a minimum monthly balance of US$100,000 in the account. If the Client fails to maintain the minimum balance for 11 consecutive months, they may be subject to a monthly fee of US$500.

(4) These recommendations may not be suitable for all types of clients. Suitability will depend on the client's risk profile. For more information, please consult your advisor.